As I was building Beyond Pricing, very early on we wanted to focus on building a company based on the right ratios.

One of the best ratios I came across was the revenue per employee.

This is a great measure of how efficient you are. Both Tom Tunguz and Jason Lemkin have written great posts about this.

The main takeaway is you should target $200k revenue per employee.

Fast growing companies who are burning capital might dip down to $100k revenue per employee, but anything below that is likely not going anywhere fast and will soon run out of money.

So how do you estimate a software company’s revenue? Multiply employees by $100-200k.

Typically, the more mature the company, the closer to $200k they will be. This isn’t always the case (we definitely bucked that trend at Beyond Pricing).

Let’s look at a couple examples, using LinkedIn.

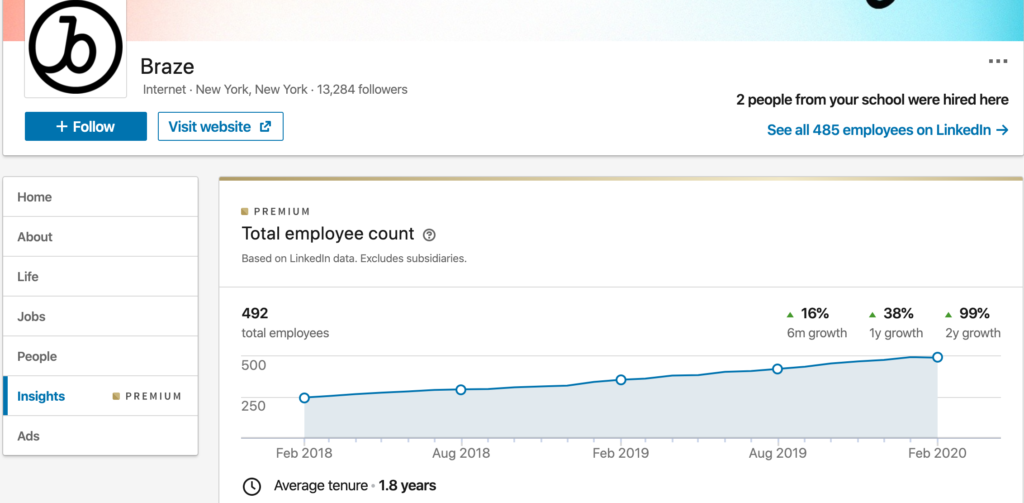

Braze has around 500 employees. They’ve been around a while, so are likely closer to $200k per employee, which would mean $100m ARR.

And look at that. That’s exactly what they’re at: https://www.braze.com/perspectives/article/braze-tops-100-million-arr

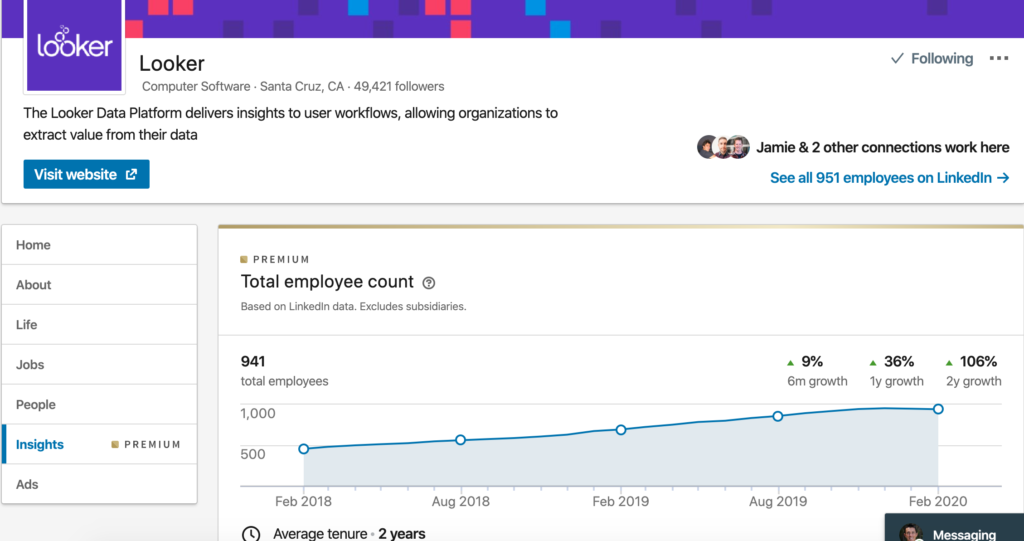

Looker as around 900 employees. We’d expect them to have around $180m ARR if they were at $200k revenue per employee.

About a year ago, based on employee growth rates, they had around 650 employees. Back then, they claimed to have $100m ARR. That puts them right around $150k revenue per employee, right in the middle of our range. If we use that number to update our estimate, they’d be at $135m ARR, right around the $140m Cowen estimates.

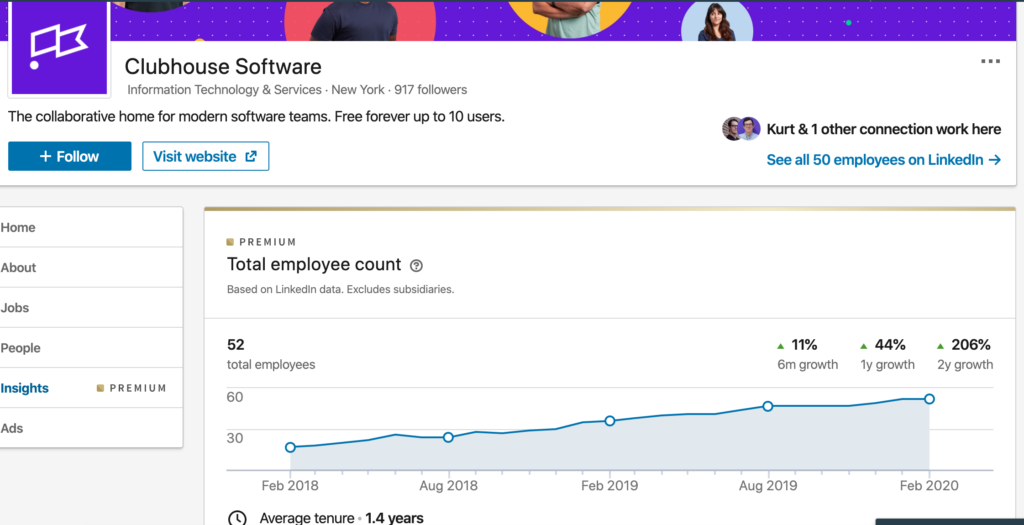

One final example with a disclosure that I know the founders but don’t actually know their revenue. Clubhouse recently raised a Series B and has around 50 employees. I’m going to guess their ARR is right around $5m.

This is further supported by a couple posts about average ARR for different rounds (here and here). tldr; Series A: $1-2m, Series B: ~$5m. I’ll let Kurt and team confirm or deny 🙂

As far as growth, in general, I’ve found revenue growth to typical be 50-100% higher than the employee growth shown on LinkedIn. For instance, looker had employee growth of around 40% according to Linkedin from 2018-2019 but they reported 70% ARR growth. This more or less matches what I saw at Beyond Pricing as well.

By the way, this is often what analysts at venture capital and private equity firms are looking at. So don’t be surprised when your employee growth rate is above 50% (meaning you’re likely 2x-ing or more) and your employee count is approaching 50 to get those calls from Series B investors. I know we did!

A final note: this is only for US-based software companies. They don’t really apply in other countries where labor is much cheaper or other industries, where average wages are much lower.